Executive Summary

Settlement of any transaction is at the core of any trade or transaction that takes place between two parties or through exchange mechanism. From 2008 till 2017, the clearing house or exchange settlement was on T+3 basis, T being the Trade Day. Industry felt the need to shorten the settlement cycle further and the markets started following T+2 settlement since 2017. Now to reduce the settlement risk further and cater to the increasing demands of the customers, many regulators across the globe have proposed to expedite settlement further down to T+1 in next one or two years.

The shortened settlement brings many benefits from driving efficiency in trade settlements, reduction in volatility, reduced market risks or lower margin requirements. Following are the primary objectives that are more pronounced especially during uncertain scenarios like pandemic or war conflicts.

• Manage increased systemic & idiosyncratic risk as stated above

• Reduce overall settlement risk – longer the period for settlement, greater the credit, market, liquidity risk for the market infrastructure

• Accelerate the settlement cycle that all clients are demanding now – from institutional to retail

• Improve liquidity in the overall eco-system through faster settlement

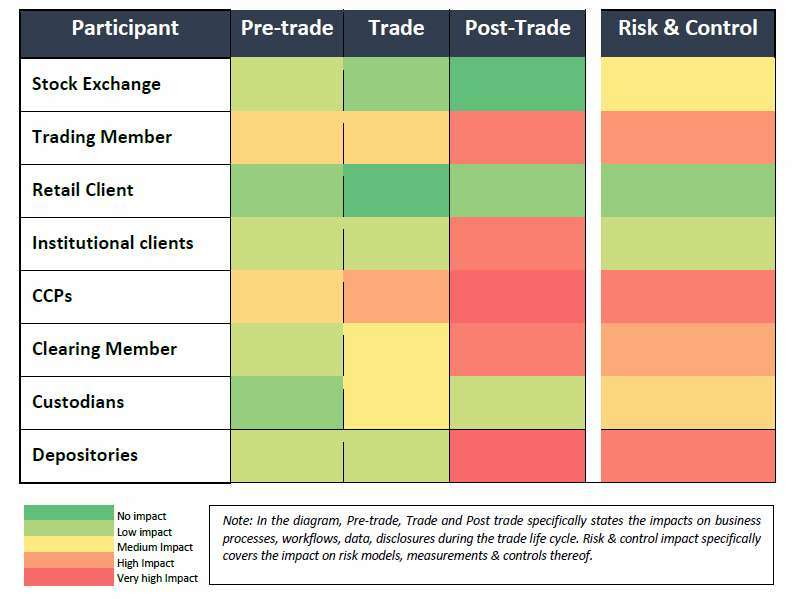

This paper focuses on our point of view on what this means for the market participants and how they should respond to this situation. We have started with a detailed impact assessment of this settlement compression for different types of market participants at various stages of the trade life cycle and specifically from Risk & Control perspective. We have then analyzed how the market participants may think of revisiting their business and operating model and the capabilities they should try to enhance. This is followed by the broad challenges the entire eco-system of the participants and intermediaries should approach this transformation journey. Finally, we have concluded with our view on the road ahead for the market participants with a futuristic outlook.

How are the intermediaries impacted?

The proposed T+1 changes will impact almost each of the intermediaries in the ecosystem. However, the intensity of impact may vary.

• Entities that are impacted the most such as CCPs, Depositories must disclose data and change plans

publicly to take up the changes of the entire ecosystem together

• Other entities viz Clearing members, trading members must ensure their clients are well informed

about the change with investor education programs

What are the impacts?

The suggested acceleration in settlement process will have impact at various stages of the trade life

cycle.

Trade matching & confirmation

• Change the affirmation deadline to sync up with the timelines for global participants (e.g. from

11:30 AM ET on T+1 to 9:00 PM ET on T Day)

• Encourage timely allocations (e.g. by 7:00 PM ET on T Day)

• Automate trade matching and communication protocol

Settlement risk

• Promote greater adoption of Standard Settlement Instructions

• Market participants should proactively identify key drivers for settlement failure and address those

• Equity based products viz. securities lending and borrowing (SLB) will require early settlement, else short selling including reverse arbitrage will be impacted

• Liquidity arrangements would be concern for initial days

Global Settlement implications

• Promote T+1 process globally to avoid time lag and ensure consistency

Corporate Actions

• Exchanges to align ex-date with record date for regular corporate actions

• Derivatives adjustments to have effect on corporate actions

• Adopt automated communication protocols like SWIFT

Trade documentation

• Promote e-delivery as the mode for receiving trade documentation

• Change the rules that inhibit clients from receiving e-delivery of investor documents

• Trade documentation to link to the affirmation/ pre-trade confirmations

• Operational re-alignments required, if not addressed in time, may affect trade reconciliations

How should Financial Institutions respond?

The financial institutions must take a fresh look at its business and operating model and strive to augment their system and technology capabilities to drive this change successfully.

Revisit and re-think business and operating model

• Updates to operating model with all checks & balances throughout the trade life cycle e.g., trade matching must be in line with institutional demands, pre-trade confirmations, final obligations etc.

• Participants to re-estimate liquidity needs since the cost to market liquidity may get affected due to shortened settlement cycle

• Depositories to optimize processes to upkeep shareholders register & expose the required data to respective stakeholders

• Eco-system to drive active reconciliation with depositories & up to date rules for margin calculations, settlement shortage & default management

Centralized workflow and exception management

• Real time data processing capabilities with every stakeholder to process the data and expose the data elements to required stakeholders

• Centrally mapped mid-office and back-office processes to process data viz. trade confirmations, volatility valuations, VaR, asset prices, participant limits, limit violations to integrate the processes like margin calculations and updates, obligations updates, master data integrations, achieve settlement finality etc.

• Automated limit management on short selling at various levels

• Business and system resiliency is critical to complete the processing on time

Accelerated data integration and interfacing

• Trade matching process and capability to match the economics

• Faster data integrations through advanced and niche technologies like Apache Kafka or Service Bus

• Closer integration of the mid-office and back-office systems to crystalize final obligations faster

• Calibrate the data migration/ replication between the CCP associations

• Calibrations in trade engines to ensure that the orders are matched as per the e-documents/ agreements

Faster messaging capability

• API or equivalent usage of technology to ensure the data is clean, up-to-date and with no error

• Faster data disclosure through API using advanced techniques

• Overall database requirement may reduce as the open positions will reduce; however automated exchange of trade details need to flow and should get consumed within ecosystem

Improved data quality

• Centralized/ uniform/ standardized master data reference & maintenance to retain data integrity

• Ensuring the data entry is first time right

• Static and reference data needs to be up-to-date, else settlement failures or shortages may increase creating a disharmony in the ecosystem

• Appropriate alerting mechanism for inaccurate/ incomplete data and information

• Trade restrictions as measure of control in case the static data, master data is not up to date

• Clearing houses, depositories, participant must push for increased public disclosures to ensure parity within the ecosystem.

Leveraging power of automation & AI / ML

• Minimum manual interventions to process the trades and adoption of straight through processing

• Hyper automation for processes i.e. trade validations, obligation generations, member reporting etc.

• Extensive usage of AI/ ML throughout the trade life cycle particularly in settlement shortages identification, execution of default procedures, margin recalculations etc.

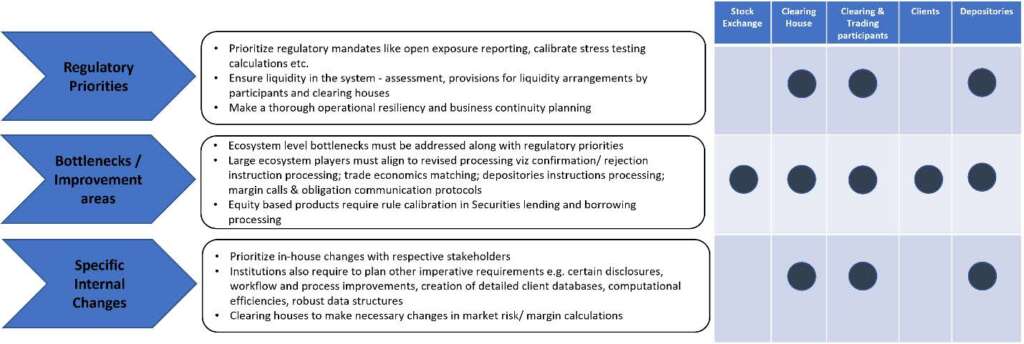

Devising an efficient approach

The market participants must design a practical and phased approach to deliver on this large transformation.

Road Ahead

There are multiple challenges to drive this program successfully for the eco-system and the biggest one is to drive change together for the entire eco-system to make it a reality.

• Difficult to drive agreement and get all market participants across ecosystem to collaborate at the same time

• Onerous task to define ownerships and responsibilities for all market participants

• Creating central sandboxes to test the overall flow to ensure smooth processing

• Non standardized public disclosures by entities may create an information disparity within ecosystem

As stated above, the market participants must re-visit their business and operating model and enhance their technical capabilities both individually as well as for the entire eco-system. The regulators across the globe must join hands to coordinate better and drive the ownership among the participants. Same day settlement (T+0) may not be a too far away and the market must be ready for that sooner than later.

Saptarsi Ray is a leading practitioner in Risk and Regulatory Compliance and Capital Markets with around 24 years of experience. He has worked as trusted advisor for banking and financial organizations across the globe and helped them in their transformation journey in Risk and Finance. He currently works as a Consulting Partner in Risk & Compliance in TCS and leads Risk Advisory for BFSI vertical across the globe for all types of Risks.

Pravin Mathakari is a leading risk practitioner with 16+ years of experience primarily in Capital Markets, Clearing house (CCP), Payment systems viz. nationally critical financial infrastructures. He worked as risk manager and as a consultant to enable the institutions in setting up of various risk functions, create & operationalize various risk frameworks across all types of risks. He currently works as a Consulting Partner in Strategic Risk Advisory in TCS and leads Financial Market Infrastructure and Payment systems vertical across the globe for all types of Risks.